Foreign-Trade Zone #107

The Foreign-Trade Zone program can offer manufacturers, processors, and importers located in the United States a number of benefits. Below are a few of the main benefits that account for most of the companies that use Foreign-Trade Zones.

- Relief from inverted tariffs

- Duty exemption on re-exports

- Duty elimination on waste, scrap, and yield loss

- Duty Deferral Foreign-Trade Zones are outside the Customs territory of the United States, goods are not imported until they leave the zone. Therefore, Customs duty is deferred until merchandise is imported from a Foreign-Trade Zone into the United States. So, instead of companies having substantial monies tied up in Customs duties on their inventory, they have use of that money for other purposes. The Foreign-Trade Zones program has proven to be a successful trade program by consistently creating and retaining jobs and capital investment in the United States.

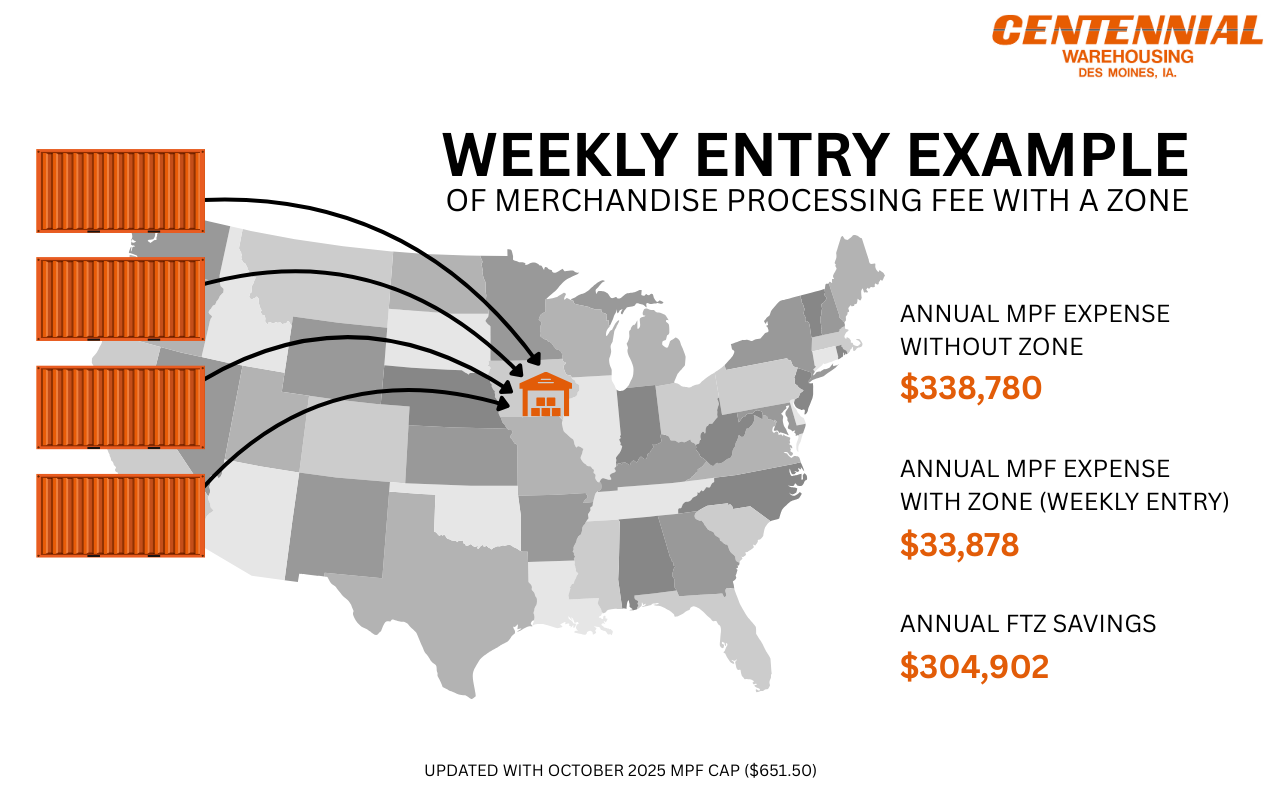

- Weekly Entry Savings Weekly Entry (allowed only to Foreign-Trade Zone users) provides economies for both Customs and Foreign-Trade Zone users. Under Weekly Entry procedures, the zone user files only one Customs Entry per week, rather than filing one Customs Entry per shipment.

For more information on the benefits of the Foreign Trade Zone, contact Centennial Warehousing.

CONTACT US

Centennial Warehousing

10400 Hickman Road Clive, IA 50325

Hours

Mon

7:30 am – 4:30 pm

Tue

7:30 am – 4:30 pm

Wed

7:30 am – 4:30 pm

Thu

7:30 am – 4:30 pm

Fri

7:30 am – 4:30 pm

Sat

Closed

Sun

Closed